https://mailchi.mp/electpatjehlen/cui-bono-tax-cuts-vs-spending-2?e=b54498e434

Dear Neighbors,

This is the second short newsletter in a short series about the tax cut proposals now being considered in the legislature. The last newsletter compared polls with opposite results, asking which, if either, represented Vox Populi. Thanks to those of you responded to the question!

I'll try to share some responses soon.

Last year, Gov. Baker proposed tax cuts totaling $700 million.

The House and Senate each proposed a tax cut package of around $500 million.

But we never reached agreement, after discovering that a 1986 law required returning $3 billion to taxpayers because of a "surplus." (More on the surplus soon.)

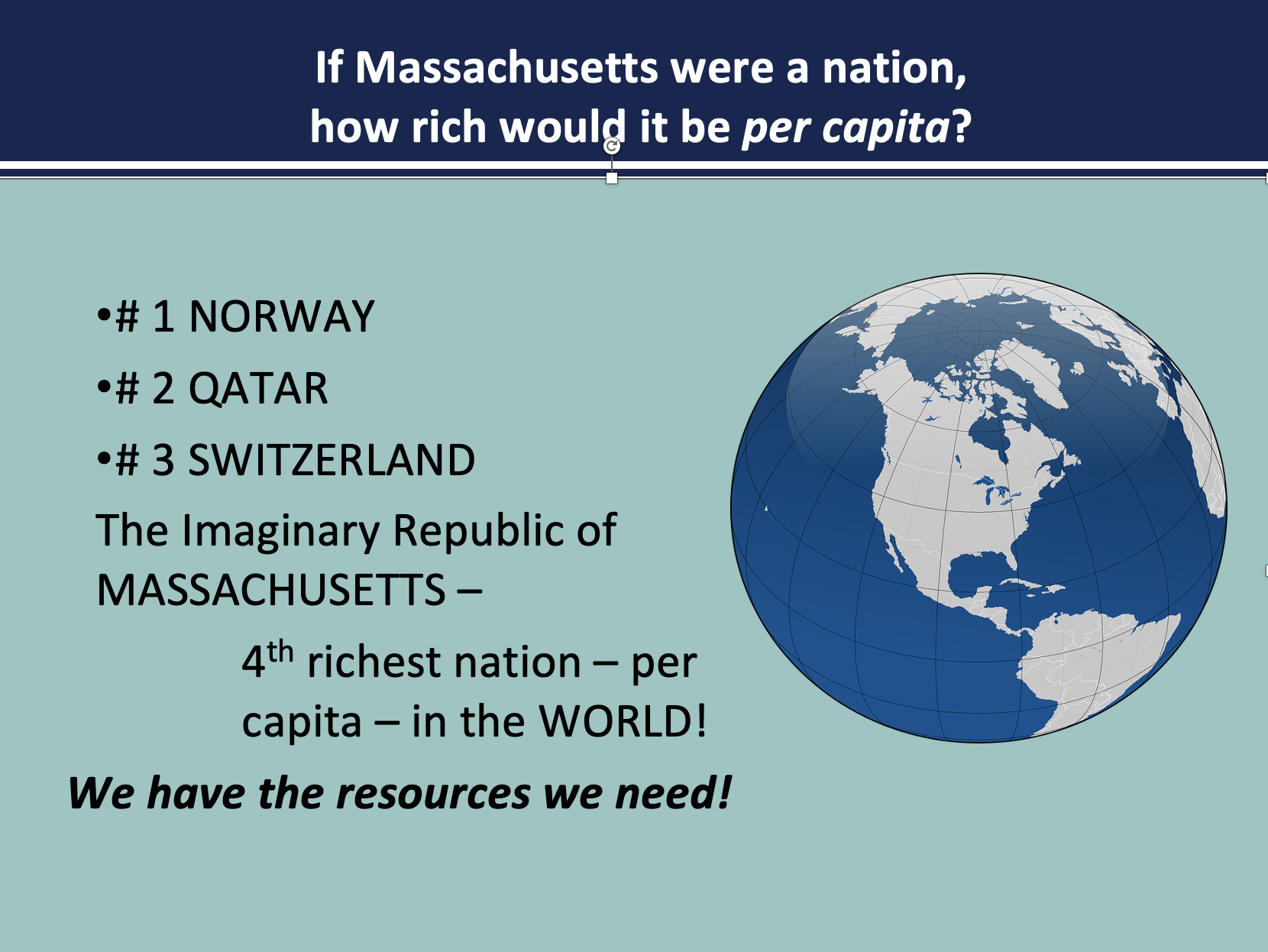

Meanwhile, following many years of work by thousands of volunteers, the voters approved the Fair Share Amendment, which will raise between $1 and $2 billion to be spent on education and transportation. The new revenue will come from a 4% surtax on the portion of any income over $1 million.

In February, Gov. Healey proposed tax cuts that will total $1 billion when by Fiscal Year 2025. (Here's a comparison with Baker's bill.) Last week, the House voted on a bill that will cut taxes by $1.1 billion when phased in. As the Senate prepares to vote on its own version, one question is:

Cui bono?

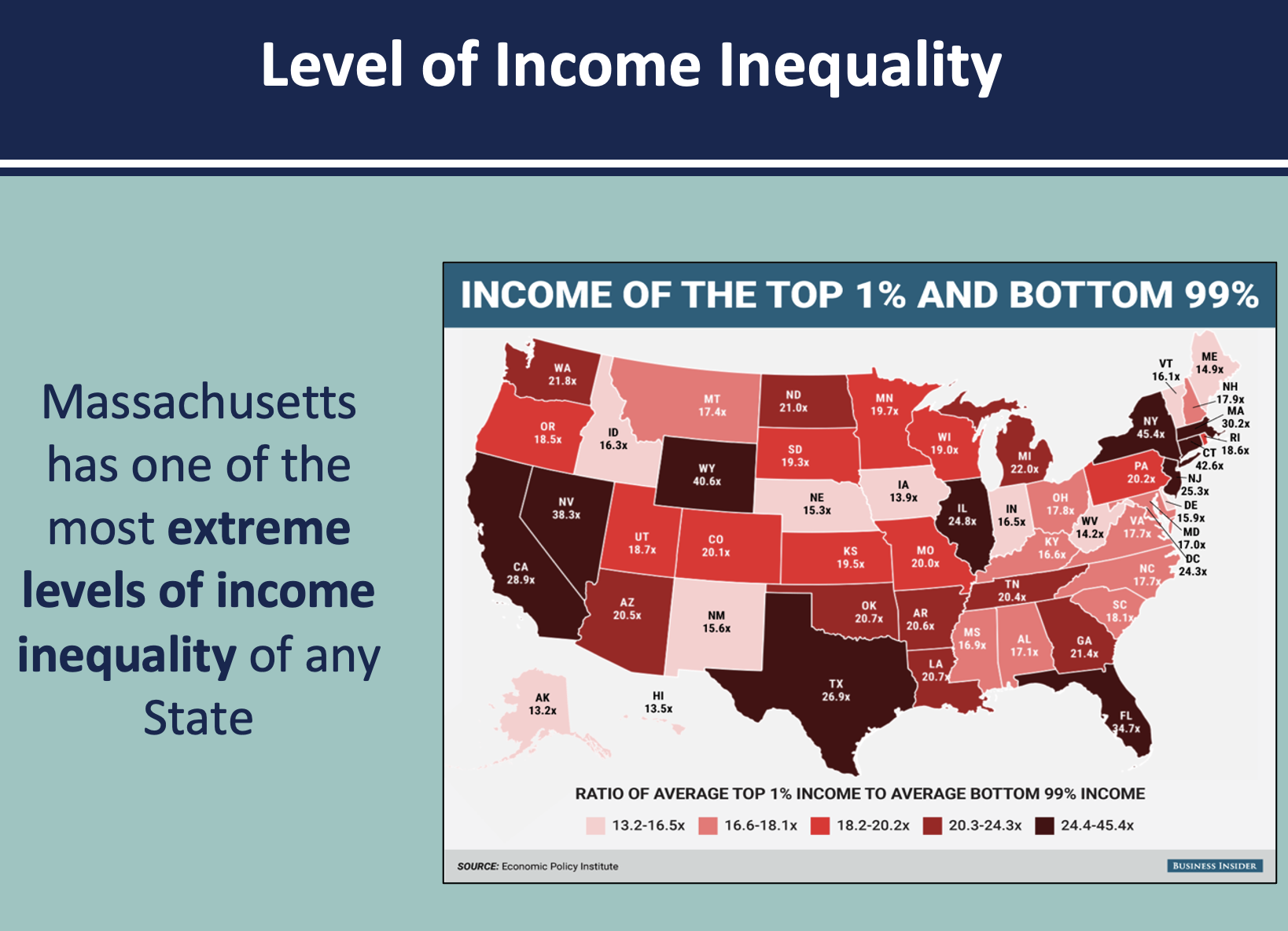

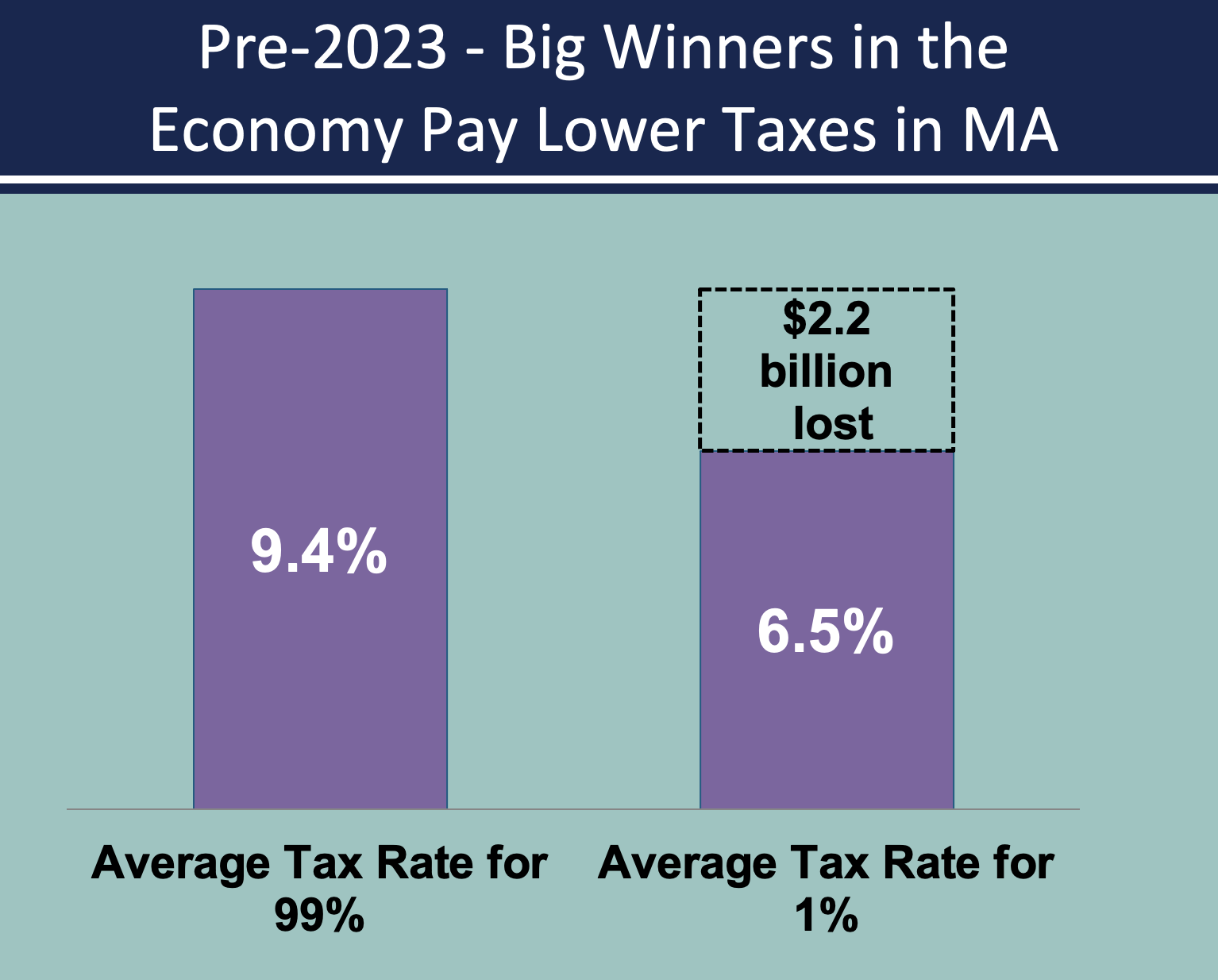

Who will benefit from these proposals? The simplest explanation of Gov. Healey's proposal is in these slides from RaiseUp, the folks who worked for the Fair Share Amendment. The House plan contains similar provisions. Thanks to Raise Up for the graphics! (With comments by me.)

Those numbers include all state and local taxes, including the regressive sales tax, excise tax, and local property taxes. An opponent of the Fair Share Amendment has confirmed the highly regressive total tax structure in Massachusetts.

The Fair Share Amendment (FSA) is projected to raise $1 to 2 billion in new annual state revenue, dedicated to education and transportation.

The tax cuts proposed by the Governor and House are about the same as increased revenue generated by the FSA. Both the Governor and the House preserve the FSA spending on transportation and education, but limit or cut spending in other areas. The reductions in revenue and spending will be greater in future years as tax cuts are phased in, especially if there is a widely expected recession or slowdown in the economy.

We in the Senate are now actively discussing what we should do about taxes and spending in this year's budget. Is this information helpful? Comments and questions welcome!

Stay in touch!![]()

|

0 comments:

Post a Comment